China has sharply expanded its export controls on rare earth elements and related technologies, tightening its grip on a strategically vital sector just weeks before a possible meeting between US President Donald Trump and Chinese President Xi Jinping in South Korea.

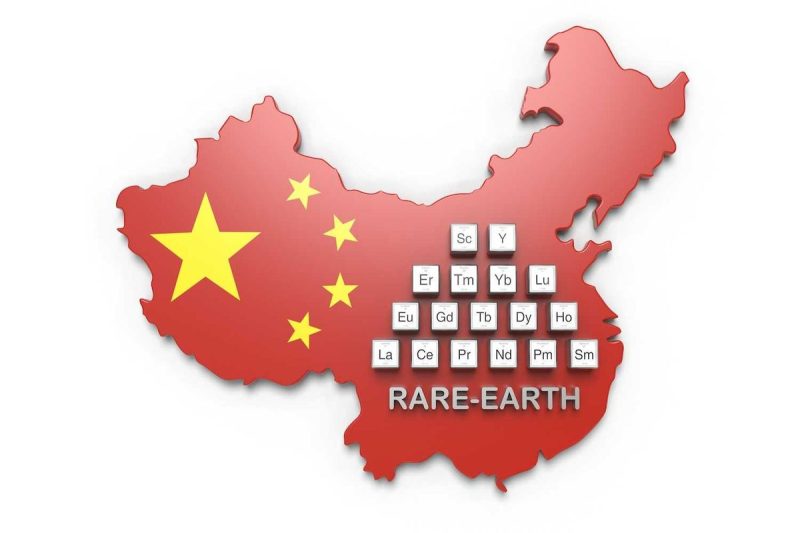

The Ministry of Commerce announced Thursday (October 9) that five additional rare earth elements: holmium, erbium, thulium, europium, and ytterbium, along with dozens of refining technologies and pieces of equipment, have been added to its export control list.

Foreign companies that produce rare earth materials or magnets using Chinese equipment or materials will now require export licenses from Beijing, even if no Chinese entity is directly involved in the transaction.

Applications linked to defense industries or advanced semiconductor production, such as 14-nanometer chips, memory chips with 256 layers or more, or artificial intelligence with military applications, will face heightened scrutiny or outright denial.

Rare earth elements are essential to manufacturing electric vehicles, wind turbines, smartphones, and defense systems, including fighter jet engines and radar. China accounts for about 70 percent of global production and over 90 percent of processing capacity, giving it a near-monopoly over the supply chain.

The new measures take effect in stages: restrictions on rare earth exports and processing technologies begin November 8, while the rules governing products made with Chinese inputs will come into force on December 1.

The move also tightens Beijing’s control over Chinese nationals, prohibiting them from engaging in overseas rare earth mining, magnet manufacturing, or technical consulting without official approval.

Meanwhile, companies outside China are emphasizing their independence from Chinese materials and technology.

Energy Fuels (NYSEAMERICAN:UUUU,TSX:EFR), which operates a uranium and rare earths facility in Utah, said that it is ramping up domestic production to counter supply risks. Meanwhile, NioCorp NASDAQ:NB), which is developing a rare earths mine in Nebraska, said the move reflects China’s increasing militarization of the sector.

“It’s clear that the People’s Liberation Army is increasingly calling the shots on rare earth policy in China. That means even more difficult times both for the Pentagon and for a wide range of commercial manufacturers,” the company told Reuters.

Ucore Rare Metals (TSXV:UCU,OTCQX:UURAF), a Canada-based developer of rare earth separation technology, said its Louisiana Strategic Metals Complex (LA-SMC) will remain unaffected.

“Today’s expansion of Chinese export controls underscores why Ucore built its plan around North American and allied supply chains from day one,” said Ucore CEO Pat Ryan in a recent statement. “Our RapidSX refining technology not only produces the same rare earth products, at the same quality, as legacy solvent extraction, but does so with faster throughput in a much reduced floorspace.”

Ucore said its equipment sourcing strategy relies entirely on North American suppliers and is protected under the US Defense Priorities and Allocations System (DPAS), which prioritizes key national defense projects to ensure supply chain resilience.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.